Content

- Finest No-deposit Gambling establishment Incentives inside the Canada 2025

- 📜 Conditions and terms because of it Underdog Dream deposit incentive

- Very first Secure Bank and you may Believe pays $a dozen,375 flood insurance coverage-related penalty

- Review of Dumps Survey and you can Filing for Summer 29, 2023

- Albert Fried & Team will pay for SAR downfalls

You can’t really end playthrough standards the bonus, like the no-deposit one to, if they are expressed in the conditions and terms of your own offer. For many who deliberately prevent these types of requirements, you simply will not manage to withdraw the newest winnings you’ve received which have the advantage. Do remember that this bonus always pertains to slot game that is dominantly available because the free No deposit spins for the specific titles. On the hardly ever occasions, you can allege a no deposit bonus in the way of added bonus cash to possess spending on alive gambling games and you can desk video game such as black-jack and you will roulette.

Finest No-deposit Gambling establishment Incentives inside the Canada 2025

Appian incorporated Zou, a software designer, in the new lawsuit, and he is actually ordered to pay Appian $5,000. “The newest appellate court’s 60-page choice is actually unanimous, so we trust Appian would have to defeat multiple, thorough and you may well-reasoned grounds so you can overturn the brand new appeals court decision,” Pega added regarding the report. Then, a section away from about three Virginia Courtroom from Is attractive judges inside July 2024 reversed the fresh verdict and you may purchased another trial, stating that Appian are defectively alleviated of the weight away from proving you to definitely Pega economically gained out of misappropriating Appian’s exchange gifts.

📜 Conditions and terms because of it Underdog Dream deposit incentive

Since the law’s active date is retroactive, SSA need to alter mans earlier professionals in addition to future benefits. SSA is helping extremely inspired beneficiaries today, but below SSA’s latest budget, SSA wants one specific state-of-the-art times that have to be processed yourself could take around one year to regulate benefits and you can pay-all retroactive professionals. SSA is control pending or the fresh claims to have professionals and you can playing with automation to expend retroactive advantages and increase monthly benefit costs to those whoever professionals were affected by the newest WEP and you will GPO.

Very first Secure Bank and you may Believe pays $a dozen,375 flood insurance coverage-related penalty

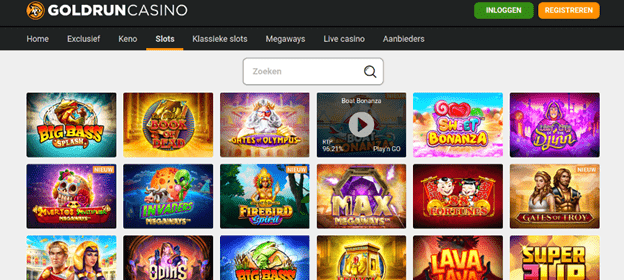

The better-identified and you can the fresh casino within the Canada to your No-deposit invited extra alternative is designed to prompt the new participants to keep to play and you may making actual awards. This can be some thing, including free revolves and money and you may finish to your VIP respect system added bonus points that is going to be after that turned into higher prizes. The top discover because of it day are Lemon Casino’s 20 100 percent free twist incentive rather than a deposit on the Larger Trout Bonanza online slot.

Processing moments to possess CFPB-watched organizations echo committed from when the brand new CFPB efficiency their comments to the FDIC so you can in the event the report away from test are delivered to the lending company. Control times mirror the period of time from when industry job is over in order to when the report away from examination is sent for the lender. Great Western Lender, which had been gotten because of the Basic Interstate Financial, is actually a financial company which have metropolitan areas inside the Iowa, Colorado, Southern Dakota and Nebraska, as well as a banking office inside Scottsbluff, Nebraska. Higher Western Bank’s dumps were covered from the Federal Put Insurance policies Business. The brand new jobless speed analytics is actually collected because of the Bureau away from Labor Analytics, and you may like the PCE rate index are utilized as the a barometer of one’s country’s monetary health.

Review of Dumps Survey and you can Filing for Summer 29, 2023

That with an excellent DINB and you will declaring an progress dividend, the brand new FDIC wished to minimize interruption for covered depositors and offer a way press this link here now of measuring instantaneous save to the uninsured depositors if you are the fresh agency worked to respond to the college. The brand new FDIC didn’t foreclose the possibility that various other business you may purchase the places otherwise assets of one’s hit a brick wall financial, an unrealistic but much better result to help you liquidation. Over the weekend, the brand new FDIC definitely solicited desire to own a purchase and presumption away from the newest unsuccessful bank.

Albert Fried & Team will pay for SAR downfalls

Now, Appian’s desire was read by the state Supreme Courtroom, the newest courtroom felt like March 7. It’s the new turn in the fight between Appian, that is located in Fairfax County’s McLean urban area, and you will competition Pegasystems. Inside 2022, Appian claimed what was projected to be the greatest award within the Virginia state court history immediately after they sued Massachusetts-centered Pega and you will a single, Youyong Zou, inside 2020, alleging one to Zou, an employee from a government company using Appian app, considering Pega having usage of the brand new backend of this application.

The fresh FDIC and Earliest-Citizens registered to your a loss of profits-share deal to the industrial fund they bought of your former SV Link Lender.36 The newest FDIC since the receiver and you will First-Residents tend to show on the losses and you will potential recoveries on the financing covered by the loss-display agreement. The loss-share deal is estimated to increase recoveries to the possessions because of the remaining her or him regarding the personal market. The order is additionally expected to do away with interruptions to own financing users. To the March ten, 2023, simply more than 14 days ago, Silicone Area Financial (SVB), Santa Clara, Ca, having $209 billion inside the possessions from the seasons-prevent 2022, is actually finalized by Ca Company out of Economic Defense and you will Advancement (CADFPI), and therefore appointed the new FDIC because the individual.

SSA advises you to definitely, until they get a notification away from SSA, anyone is to always proceed with the recommendations to the Medicare superior statement and you can afford the costs to make certain their Medicare publicity doesn’t prevent. SSA will be sending an alerts advising anyone whenever their Personal Defense listing are up-to-date. As the people initiate getting a social Defense work for, the brand new Medicare premium would be deducted using their payment per month. In case your work with isn’t adequate to shelter the fresh Medicare advanced, anyone will be recharged to your rest.

The main Specialist Borrowing from the bank Facility today allows eligible first traders to help you acquire during the existing Discount Price for approximately 120 weeks. Subsequently, as the word-of SVB’s issues began to bequeath, Trademark Lender started to sense contagion effects with put outflows you to definitely began to your March 9 and you may became intense on the Tuesday, March 10, to your announcement of SVB’s inability. On the February ten, Trademark Financial forgotten 20 percent of its overall deposits within the a good question of days, using up its dollars status and you may making they that have a bad harmony to your Government Set aside by close of organization. This was accomplished which have times so you can spare until the Federal Set-aside’s wire space closed. Regardless if you are maybe not willing to invest in a pleasant incentive otherwise have to appreciate game at no cost, the best no-deposit offers enables you to speak about the brand new realm away from web based casinos to the fair terminology.

“Inside a far more water financial environment we are still really capitalized and you can all of our well-varied company will bring resilience, once we live our very own intent behind helping build dreams genuine inside another 1 / 2 of the fresh fiscal year.” Because of normal on the-website assessments and contact having county nonmember organizations, FDIC staff regularly chat to banking companies in order that their principles to deal with borrowing from the bank risk, liquidity risk, and you can desire-rate chance work well. In which appropriate, FDIC personnel work on establishments which have significant experience of these dangers and you may cause them to become bring suitable exposure-mitigating procedures.

Centered on Goodman and Shaffer (1984), brokered dumps failed to to begin with produce to boost effective deposit insurance rates constraints. Alternatively, they developed in the fresh sixties and seventies for banking companies to get day places, for example, Dvds, away from outside their own field and depositors to find large costs. However,, inside 1982 Penn Rectangular Lender hit a brick wall, and the FDIC liquidated they while the FDIC are not able to see a buyer; holders of uninsured Penn Square Cds took losses.5 These types of losses led deposit brokers to start splitting up Dvds to your $a hundred,100 increments—the fresh FDIC insurance policies restrict at that time—to incorporate far more put insurance. The newest Government Set-aside Program implements financial coverage mostly from the focusing on the newest government financing rates.

Compared to 100 percent free spin also offers, incentive No deposit bucks alternatives during the casinos on the internet is much less common. Casinos attach incentive requirements to help you also offers as they allow them to personalize no deposit incentives in order to a specific representative group. Particularly, they may set up a password to own cellular casino users otherwise those people opting for a certain fee means, and because no-deposit bonuses is a rareness, codes have private sales. Thus, sometimes, incentive requirements might not be readily available inside the casinos even though he’s her or him.